|

|

InCharge-Home edition Samples

ICH is the result of years of practical situations

Obviously, not all that is provided by ICH applies to everyone

Expenses / Bills:

• Everyone has recurring bills

• Everyone has variety of personally specific expenses

• Most people use Credit Cards

• Credit card charges are usually left unrecorded (trouble brewing)

• Credit Card charges usually bring a surprise when the statement arrives

• Written Checks are recorded in a check register

• Debit payments are (should be) recorded in the same check register

• Majority of people are employed and receive a W2 at year end

• Some people work as Independent Contractors (may or may not get a 1099)

• Some people own rental Property

• Some people maintain one checkbook while others track multiple checkbooks

The Samples:

• The reports shown are created automatically as the result of:

- • Recording Deposits (as you do now)

- • Recording Payments (as you do now)

- • Recording Credit Card charges (as you should be doing; they are payments)

• A unique feature of ICH is that when a deposit is recorded, it is internally allocated to each expense that you defined

(money is set aside for when the Bill / Expense is due)

Business Activity:

• Schedule "C" tax reporting (Independent Contractor; Side Business)

-Track income & expenses of new ventures without having to open multiple separate checking accounts and credit cards (be careful, you can't always do that; like LLC) But you can track separate checking accounts. Full fledged businesses should use Business Accounting software.

• Schedule 'E' tax reporting (Rental Property)

-Track multiple rental properties without having to open multiple checking accounts

Other:

• Gather information for 'Special' reporting

-(ever have to fill out Court papers with information on expenses?)

ICH is the result of years of practical situations

Obviously, not all that is provided by ICH applies to everyone

Expenses / Bills:

• Everyone has recurring bills

• Everyone has variety of personally specific expenses

• Most people use Credit Cards

• Credit card charges are usually left unrecorded (trouble brewing)

• Credit Card charges usually bring a surprise when the statement arrives

• Written Checks are recorded in a check register

• Debit payments are (should be) recorded in the same check register

• Majority of people are employed and receive a W2 at year end

• Some people work as Independent Contractors (may or may not get a 1099)

• Some people own rental Property

• Some people maintain one checkbook while others track multiple checkbooks

The Samples:

• The reports shown are created automatically as the result of:

- • Recording Deposits (as you do now)

- • Recording Payments (as you do now)

- • Recording Credit Card charges (as you should be doing; they are payments)

• A unique feature of ICH is that when a deposit is recorded, it is internally allocated to each expense that you defined

(money is set aside for when the Bill / Expense is due)

Business Activity:

• Schedule "C" tax reporting (Independent Contractor; Side Business)

-Track income & expenses of new ventures without having to open multiple separate checking accounts and credit cards (be careful, you can't always do that; like LLC) But you can track separate checking accounts. Full fledged businesses should use Business Accounting software.

• Schedule 'E' tax reporting (Rental Property)

-Track multiple rental properties without having to open multiple checking accounts

Other:

• Gather information for 'Special' reporting

-(ever have to fill out Court papers with information on expenses?)

Just like you do now...

• Record the deposits

• Record the payments

All these Reports (and more) are produced automatically at the click of the mouse

• Record the deposits

• Record the payments

All these Reports (and more) are produced automatically at the click of the mouse

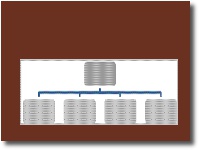

Visual of how Deposits

are handled

The Problem with Credit Cards